Terry MacGibbon has had a long and successful career in mining all over the world, to put it simply.

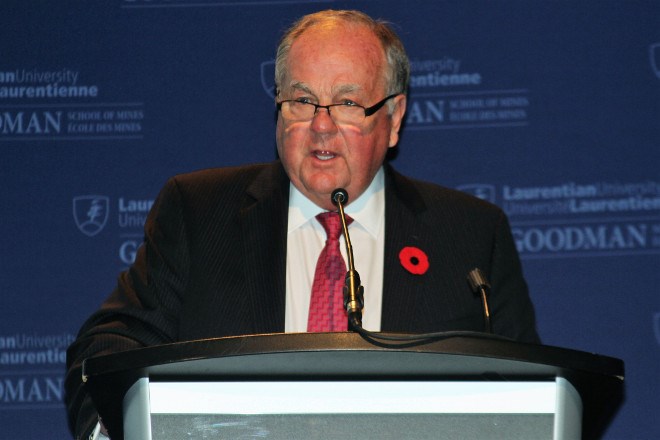

The executive chairman at TMAC Resources was happy to share his story and thoughts on how he became a major player in the global mining industry at Laurentian University's Goodman Lecture Series in Sudbury on Nov. 2.

The presentation looked at how the companies were acquired, financed, managed, the sites built and how the markets influenced their success.

The overarching message, he said, is that to be successful, one has to have passion, persistence and be willing to do some hard work.

“I tell anyone getting involved with junior companies to only get involved with really great assets,” MacGibbon said. “Without great assets, you have nothing. All four of the companies I talk about had really good transformative acquisitions. You need a great management team as well. If you have great assets, they are nothing without a great management team to move ahead.”

After assets and management, the next crucial step is finances. If people cannot get financing from the market, they should at least have good relationships with their investment banker and keep a good rapport with shareholders.

As well, a well-informed board will drive the company, he said.

Much of the lecture focused on his involvement with four mining companies: Torex Gold, FNX Mining Company, Inc., TMAC Resources and INV metals.

FNX, MacGibbon explained, was a small junior mining company he developed with just himself and a few million dollars when he was considering looking at mines located in the footwall, or outer edge, of the Sudbury basin. Fifteen years ago, he said the large mining companies like then-INCO, now Vale, were not interested in mining the footwall. He and a few partners acquired FNX Mining Company, Inc., and bought five smaller mines in the footwall: Levack, Falconbridge, Podolsky, McCreedy West and Victoria.

“I don't think INCO thought we would be very successful, as they thought those mines were completely mined out,” he said.

At their deposits, he said they were fortunate they didn't have to put too much into infrastructure and put their discoveries into production quickly, earning them returns in a short time and stabilizing the company's finances.

“The high nickel price and INCO's insatiable need for raw ore in their smelter kept us growing,” he said.

Their successes in the mines led FNX to climb on the stock market as well, from pennies a share to nearly $40, and it was the best performing stock on the TSX for the first decade of the 21st century.

“I used to joke with my investment banker friends that my miners produced about $1 million each annually, more than any of them got paid,” MacGibbon said.

His next success was in Mexico with Torex Gold. The company had a deposit near a village, but they had to help smooth over tensions when residents blocked the road, sitting on lawn chairs and carrying machine guns.

“Coming from Sudbury, seeing people sitting in lawn chairs with machine guns blocking a road, you'd take union any day,” he quipped.

The problem, he said, was their tailings pond would wash over the existing village, so they had to work with residents to relocate and build a new one.

“We built them a new and better village, working with them, as it was their land,” he said. “We had to consult on everything, even building a new church and we found out 30 per cent were Jehovah's Witnesses, so we built a temple as well.”

That attention to consideration also came in handy when they went to Nunavut to acquire the Hope Bay mine site from Newmont. He helped acquire TMAC Resources, and through careful negotiations with the Qikiqtani Inuit Association opened the mine site.

“We need to remember we are there as a privilege; it's their land,” MacGibbon said.

His latest acquisition, INV Metals, has been a lesson in environmental stewardship and social responsibility. He said they are designing a mine that will have very little environmental impact: the smelter is being designed to be aesthetically pleasing, half of the waste, an estimated 10,000 tons, which will be mostly silica, will be used to fill in the mine, and the rest will be re-vegetated on the ground.

With all the successes in mining he's witnessed, MacGibbon said there are still many places for improvement, such as getting more women into mining. Two of the companies he's co-founded have women as their CEOs and, at TMAC, most of the geologists and three of the seven executives are women.

“It makes no sense to me to exclude half of the world's population from mining,” he said. “I was pleased to see more women students in the school, but we have to bring in more, from executives to trades.”