A resuscitated Red Lake mine project has come full circle with the release of a positive feasibility study for a now "shovel-ready" development.

Battle North Gold is placing an 8.2 year mine life on the $109.3-million project in northwestern Ontario, two years longer than what was forecast in the company's preliminary economic assessment from last year.

The study supports a restart of the Bateman Gold Project, which was suddenly shuttered in late 2015 due to an egregious resource miscalculation, back when the project and the company were known as Phoenix Gold and Rubicon Resources, respectively.

The study estimates 602,987 ounces worth of gold production over the eight-year period, which would include a 21-month ramp-up toward full commercial production.

No date on the start of construction and production were included in an Oct. 21 news release.

Want to read more stories about business in the North? Subscribe to our newsletter.

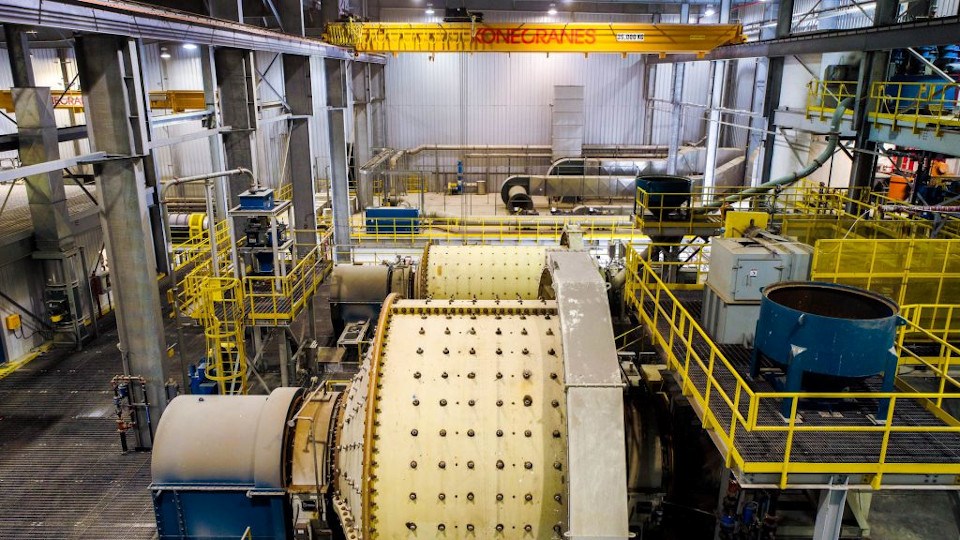

The mine planners have the benefit of having more than $770 million worth of established surface and underground infrastructure already in place with a fully operational 1,800-tonne per day processing mill, a 730-metre deep shaft and hoisting facility, a tailings management facility, and more than 14,000 metres of underground mine workings.

The company would be mining from its F2 gold deposit but infill drilling continues on the deposit with more exploration further out to gain a better understanding its McFinley and Pen Zone targets, which likely will add to the mine's operating life.

An updated gold resource estimate on McFinley and Pen are expected within the next six months as part of a larger regional exploration program of its Red Lake properties.

The Toronto-headquartered company controls 28,266 hectares of land in the Red Lake camp, along with holding more than 91,000 hectares in Nevada and Utah.

After undergoing a company name change last summer, Battle North is picking up where the previous management left off in late 2015 when trial stoping operations were halted due to a "geologically challenging" environment. It forced the layoff of more than 300 miners and contractors. The mine had been fast-tracked into production.

Coming out of creditor protection and refinancing, current company president-CEO George Ogilvie later arrived on the scene and assembled a team to begin the painstaking process of starting a new resource calculation from scratch to rebuild investor and market confidence.

"The feasibility study reflects a purposeful focus on rigor and prudence as the foundation for the prospective construction and operation of the project," said Ogilvie in a statement.

"We believe the feasibility study is a well-designed, comprehensive plan assembled under the direction of a management team and consultants with successful and extensive underground mine operations experience."

Ogilvie said the company currently has $55 million in cash that's earmarked for the project while discussions continue with lenders to secure the remaining capital to finish the development.

"I am proud of the Battle North team and the work that has been completed over the last several years to get the project to this stage," Ogilvie added.

"Subject to board review and approval, we will be tasked with initiating construction and bringing the project to commercial production. We have commenced the development planning for the Bateman Gold Project, including a full risk assessment."

In the latest investor presentation, the company said construction of the surface portal could begin as soon as the first quarter of 2021, provided that project financing is secured and a construction decision is made before the end of this year.