Inflation and supply chain issues are pumping up the price tag for Electra Battery Materials to bring a Temiskaming refinery back to life.

It will delay the plant’s startup, originally scheduled for December, moving the commissioning to the spring of 2023.

Toronto-based Electra is feeling the domino effect of the industry-wide price and supply-chain pinch, especially coming out of Asia.

The original capital budget of US$67 million to refurbish and expand the former Yukon refinery is now looking more in the range of US$76 million to US$80 million.

Electra acquired the mothballed refinery, situated north of the town of Cobalt, in 2017. The plant is being upgraded to become the first cobalt refinery in North America.

But company management isn't sweating the situation given the rapid growth in the North American electric vehicle sector, their target market.

Want to read more stories about business in the North? Subscribe to our newsletter.

Come next year, Electra will be supplying 1,800 to 2,100 tonnes of battery-grade cobalt for car and battery manufacturers as part of its hugely ambitious four-year plan to create a battery metals industrial park in the Temiskaming region in partnership with other manufacturers.

In a webcast last week, company CEO Trent Mell said he feels they’re in a good position in the early stages of a bull market for the critical minerals needed to make vehicle batteries.

Electra has more than $41 million cash in the coffers, some remaining government investment dollars to spend, new green energy government programs to tap into, and the promise of some deep-pocketed strategic partners coming aboard.

Mell said Electra has signed two commercial, non-binding, MOUs with undisclosed buyers of their product while negotiations continue with other potential customers in the queue.

“Sales are not going to be difficult.”

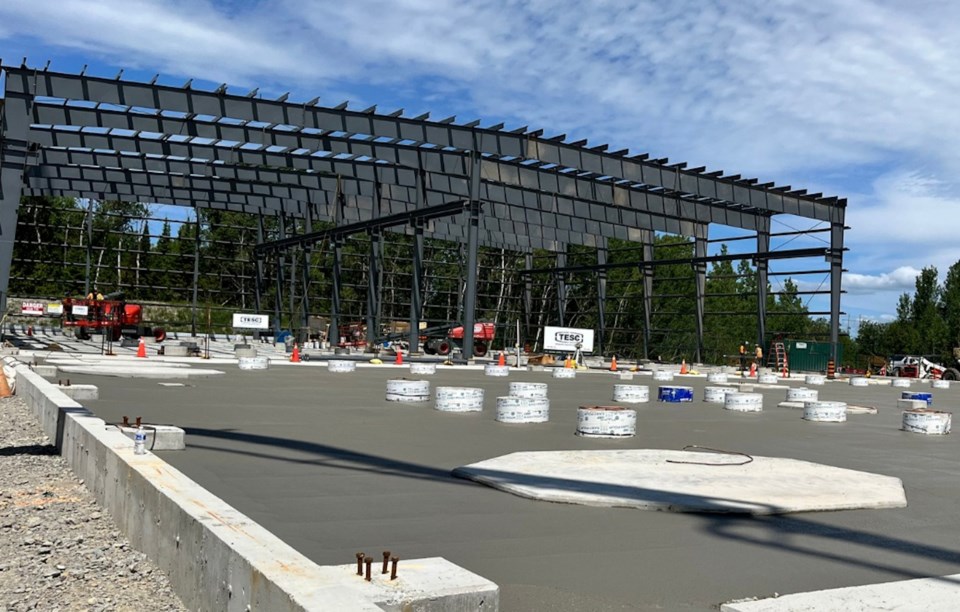

At the Temiskaming site, construction has been underway this summer on a new solvent extraction building, while work goes on inside the original refinery building to bring old equipment back into use. About 80 per cent of their procurement has been done and about the same percentage in detailed engineering work.

Though inflationary pressures have been challenging to manage, Mark Trevisiol, vice-president of project development, said his team has reacted quickly in working with suppliers to reroute where components can be manufactured and sourced from other countries.

“Our people have been on top of it.”

There’s one more snag that’s impacted the schedule.

An order for tanks will be delayed due to a quality control issue caught by the manufacturer’s inspector. A number of the tanks had to be scrapped.

Since these were “critical path” items, Trevisiol said it wasn’t possible to start plant commissioning in December.

With North American sales of electric vehicles (EV) expected to take off this decade, Electra will occupy some crucial ground between mining and battery cell manufacturing, in chemical processing of cobalt and nickel.

Sign up for the Sudbury Mining Solutions weekly newsletter here.

The company is also drawing a lot of attention for the ‘black mass’ recycling demonstration plant they want to launch in Temiskaming this fall.

Black mass is the material taken from spent batteries which are crushed, sorted and sieved into a powder. The plan to put it through a proprietary leaching process to pull out valuable metals.

“We’re looking to make several products from black mass, including nickel, cobalt and lithium,” and potentially copper, said Trevisiol.

There’s no one in North America that’s currently providing a full spectrum of recycled metal product from black mass he said.

“The focus is going to be on producing a top product that we can then market to end users,” added Mell, who mentioned Electra has been in discussions with 31 potential suppliers of black mass.

Electra is also working on a nickel study with Talon Metals and Glencore in looking at producing a nickel sulphate product in Temiskaming, a key component in the battery supply chain.

With its Nasdaq-listing in May, the Electra story is getting out there.

Even as construction proceeds in Temiskaming, Mell said the company has been invited by the Quebec government to consider expansion to Bécancour with a second cobalt refinery.

The deep-water port town on the St. Lawrence River is about an hour-and-half’s drive east of Montreal and is populated with industry.

Electra has initiated a prefeasibility study to investigate the possibility of setting up shop there.

With investment backing from Ottawa and the Quebec government, Bécancour is quickly emerging as a battery material processing hub of its own.

The town has attracted more than $400 million in outside investment from companies like BASF and General Motors, two multi-nationals with plans to build battery cathode plants.

Vale intends to pursue a nickel sulphate opportunity there and other chemical companies in the electric vehicle space are expected to arrive.

“A really, really good location for us and for the battery supply chain,” said Mell.

In talking about the prospects of their Iron Creek cobalt property in Idaho, Mell said there’s a definite North American movement afoot toward “on-shoring,” to source and process domestic supplies of critical minerals.

A most encouraging sign is the Inflation Reduction Act, that just passed the U.S. Congress, containing US$400 billion earmarked for climate and energy programs, including a generous tax credit for consumers to buy an electric vehicle.

Mell said this represents a big win for Canadian companies engaged in critical minerals mining, processing and recycling, based on our free trade agreement with Washington. And it plays perfectly into Electra’s plans.

During his recent travels to meet with potential North American buyers of Electra’s product, Mell said the on-shoring trend, across the entire supply chain, is gaining strength, a marked change in tone from two years ago.

The conversations they’re having with OEMs and their partners, he said, are not just about supply contracts but about strategic long-term visions in refining and recycling.

“The Act is shining bit of light that might accelerate some decisions.”

He expressed no worries in the volatility of commodity prices given the supply-and-demand forecasts in the electric vehicle industry.

All signs point to rapidly increasing EV sales in the U.S. with some analysts projections calling for 27 per cent growth per year through to 2026, and an estimated 27 million EVs sold by 2030.

“There’s a lot to be done. The supply chain’s got to keep up.”