With the Bank of Canada announcing a 25 basis point increase for interest rates in January, the main worry for the mortgage market in 2023 was the possibility of further rate hikes on the horizon. However, recent economic data and market volatility has had the Bank of Canada pause rates for the foreseeable future, with a potential policy reversal on the way as early as late 2023.

The Bank of Canada will be looking closely at economic data to determine whether or not they need to increase rates again to curb inflation, with an emphasis on the labour market, consumer price index (CPI), and GDP. Alex Leduc, CEO and Principal Broker at Perch shares his latest forecast numbers and what it means for the housing market.

Despite holding rates, the Bank of Canada is staying cautious

On Wednesday, March 8th, 2023, The Bank of Canada announced that it will hold the key interest rate at 4.50%, for the first time in over a year. This is anticipated to continue until the end of this year, when the Bank of Canada is expected to begin lowering interest rates again to stimulate the economy.

However, the Bank of Canada remains cautious, warning Canadians of the possibility of further increases “if needed” to return inflation to the 2% target.

The Canadian economy remains stronger than expected

According to Statistics Canada, real GDP rose in January by 0.5%, mainly due to a surprising rise in services (+0.6%) and goods-producing industries (+0.4%). This comes after December’s GDP edged down after 5 consecutive quarters of growth. Leading indicators suggest February will also post a GDP increase of 0.3%, which means that for the first quarter of 2023, GDP is tracking at about 3%, higher than the 0.5% expected by the central bank.

The Bank of Canada, in its January monetary policy report, estimates GDP will grow by only 1% annually for 2023 and highlights that we will not truly see the slowdown of the economy until later this year where “restrictive monetary policy continues to weigh on household spending, and business investment has weakened alongside slowing domestic and foreign demand.”

Bank economists believe the rate pause is here to stay

Partly as a result of Silicon Valley Bank collapsing, bond markets have undergone a significant reassessment of future rate moves by central banks, which include the Bank of Canada. Before the Silicon Valley Bank failure, it was predicted that there would be a 0.25% rate hike by mid-2023. However, after the news, bond yields (which have a significant influence on fixed mortgage rates) have dipped significantly and 5 year bond yields were down more than 30 basis points.

A minority of economists believe there will be another hike or two of 0.25% before the end of the year. Meanwhile, the majority believe that the current rate pause will be permanent until rates pivot on lower inflation and the Bank of Canada will begin rate cuts later in the year or early 2024.

RBC economists believe the most likely scenario is that the Bank of Canada will not need to hike interest rates further this year. But that call hinges on whether the previous hikes are enough to slow consumer spending and labour market momentum in the months ahead.

CIBC analysts expect the economy to evolve largely in line with the Bank’s hopes, and therefore see the overnight rate remain flat at 4.50% over the balance of the year. They believe that the Bank needs a clearer picture of where growth and inflation are headed, in order to either hike rates again or more definitively set aside that prospect. With so little time since it initiated its conditional pause, it simply doesn’t have enough data to provide that clarity. Avery Shenfield, chief economist for CIBC, says that “the economy is likely to slow in subsequent quarters without further hikes due to lagged impacts of prior rate increases.”

BMO’s chief economist, Douglas Porter, says that the Bank of Canada will likely continue its pause in rate hikes after inflation dropped to 5.2%. However the Bank could decide to start cutting rates if the collapse of Silicon Valley Bank in the U.S. and Swiss banking giant Credit Suisse prompts broader economic damage.

The current interest rate forecast:

The current market overnight interest rate forecast for the next 12 months is:

- No change on June 7, 2023

- No change on July 12, 2023

- No change on September 6, 2023

- A 0.25% decrease on October 25, 2023

- No change on December 6th, 2023

- A 0.25% decrease in March 2024

Look for fixed mortgage rates to decline slightly

Going into spring we anticipate fixed rates will decline slightly, and variable rates to remain the same as the Bank of Canada continues to pause further rate hikes. According to the Canadian Real Estate Association (CREA), sales activity rose 2.3% month-over-month, however the number of newly listed homes dropped 7.9% in February. View the latest mortgage rates from Perch, updated daily.

“The similarities between 2023 and the recovery year of 2019 continued to emerge in February, with sales up, the market tightening, and month-over-month price declines getting smaller,” said Shaun Cathcart, CREA’s Senior Economist. We expect the coming months to be more active as buyers enter the market with lesser resale inventory on the horizon.

With variable rates higher than fixed rates, now might be the time to lock in a fixed rate if you aren’t convinced that inflation will come back down to the Bank of Canada’s target.

Where are interest rates headed in 2024 and beyond?

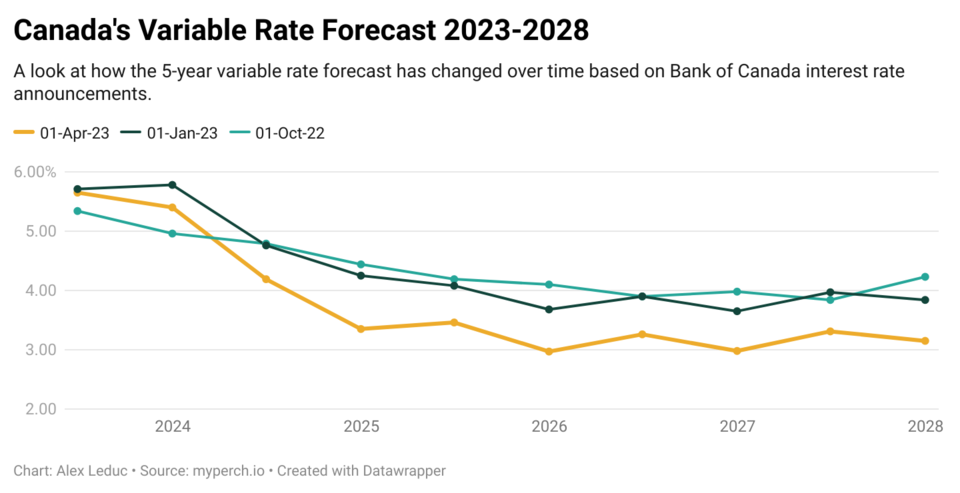

Based on our latest Mortgage Rate Outlook, expect 5-year variable mortgage rates to start dropping in 2024 and continue doing so into 2025. We'll be updating our mortgage rate forecast after every Bank of Canada interest rate announcement – you can subscribe to our mortgage rate forecast for free.

How will the housing market respond to interest rates?

When interest rates continue on a downward trend, it’s likely to drive increased demand and drive home prices up. The reason for this is that when mortgage rates decrease, homeowners can afford a larger mortgage, which drives up the amount someone would be willing to pay. With rates rising materially over the past year, the housing market slowed in most major cities across Canada. With that being said, if rates start to come back down, the current lull in the market could represent a buying opportunity.

However, mortgage rates aren’t the only factor that affect the housing market. Some analysts are predicting that supply will continue to lag behind demand going forward. Canada’s population continues to grow, adding a record 1 million people in one year for the first time since 1957. This puts Canada’s estimated population at nearly 40 million, with a 2.7% annual population growth. At this rate, it would only take 26 years for Canada’s population to double. In the short term, analysts are predicting this will add further pressure on housing supply and the rental market.

Alex Leduc is the CEO and Principal Broker of Perch, an award-winning digital mortgage brokerage on a mission to simplify homeownership. With 10+ years in the mortgage and finance industry, Alex is Co-Chair of the Canadian Lenders Association Mortgage Roundtable and a Technical Advisory Member of the Financial Services Regulatory Authority of Ontario (FSRA). Alex is a graduate of Ivey Business School from Western University and a CFA Charterholder.

Buy the right property sooner, find your mortgage and build wealth through real estate with Perch. Call 1-844-415-8263 or visit www.myperch.io to learn more, and apply today.