The proponents of a potentially large platinum and palladium mine near Thunder Bay believe they've only scratched the surface of its vast metal potential.

This week, Clean Air Metals released a preliminary economic assessment (PEA) of its Thunder Bay North Project, forecasting a 10-year mine operating life. But company officials insist that's only the "minimum" as their property has the resources in the ground to last much longer.

"The great thing about this project is that it has tremendous exploration upside," said company CEO Abraham Drost, in laying out the initial base case for an underground mine, 40 kilometres north of the city.

"We've committed to...a high-grade underground mine, and that is what we've been able to deliver here," he said.

Drost and Jim Gallagher, the company's executive chair delivered a project update in a Dec. 2 web call to investors, a day after releasing the PEA of their predominately platinum group metals-nickel-copper project.

Along with some gold, silver, cobalt and rhodium thrown in the mix, the company is touting its "green energy suite of metals" to the market; all key ingredients needed in the "zero-emission energy revolution."

The company has two rich deposits to tap into. The Current deposit, on the east side of 29,725-hectare property, is the most advanced for the two. The Escape deposit, two-and-a-half kilometres to the west, is still undergoing a considerable amount of drilling this fall and winter.

But Drost said there was enough of a favourable initial resource at Current to start formulating a mine plan.

The mine project's capital costs over a decade-long span are $536 million, with $367 million of that upfront in construction costs.

A PEA is only the first glimpse of what a mine could look like. A more detailed study, in the form of a pre-feasibility study, comes out in the third quarter of 2022. It will provide a better picture of what a mine will look like.

By then, the company will have an updated resource estimate, based on more than 70,000 metres of drilling, and possibly have a deep-pocketed joint venture partner aboard to help carry the project into production.

"Pretty good odds on even chance that this gets developed," said Drost.

Clean Air hasn't made a mine construction decision yet, but if they did, Drost said they could be production within six months.

There are two high-grade zones within 50 to 60 metres of the surface, the highest grades on the property. Six months into ramp development, "and you're into it," said Drost.

Production from a high-grade zone at the Escape deposit would come online by year four.

Building a processing mill and all the mine-related infrastructure would take 24 months, meaning early ore production would have to be temporarily processed by another mining company.

Drost is hoping Thunder Bay North could grow in resources to be on the scale of Norilsk, Russia - one of the world's most prolific mining camps since 1920 - and its Talnakh Field. He said most of the characteristics in the geological structure between Thunder Bay North and Norilsk seem to match up.

The company said as much last March after the discovery of massive sulfides on the property.

In following the Norilsk model, the company believes there are top-of-the-scale massive sulphide deposits somewhere on the property. They're earmarking 16,000 metres of drilling in January to follow up on some prospective targets.

In mine planning, the company emphasized it's making a concerted effort to minimize its environmental impact on the land.

Gallagher noted the previous holders of the Current deposit, Australia's Panoramic Resources, once envisioned a large open-pit mine with a 90-million tonne waste pile. It would have involved draining most of a lake to do.

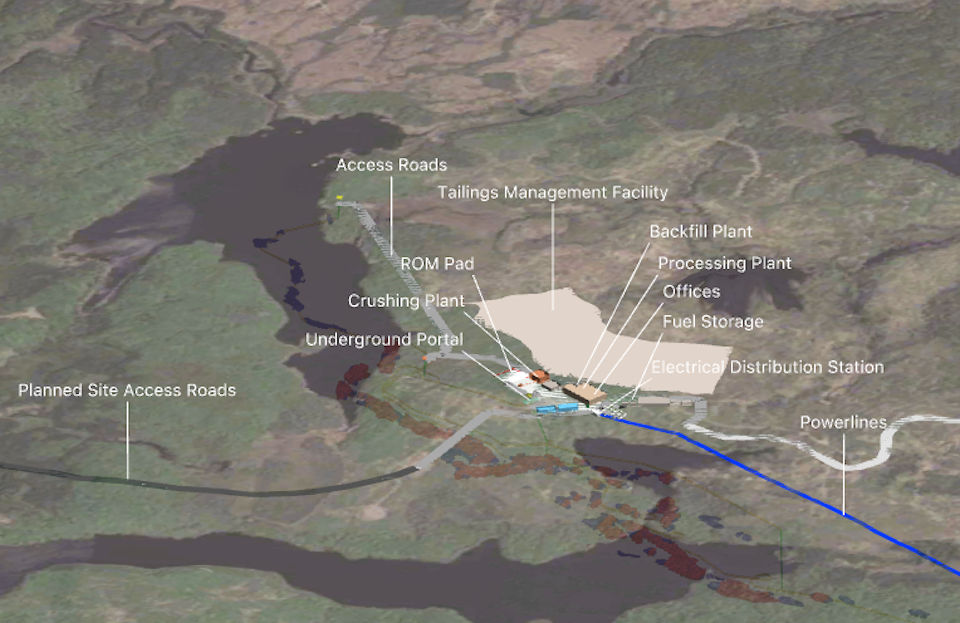

In taking the underground approach, Clean Air wants to design the mine in such a way that its operating footprint is small, with separate portals and decline ramps built for Current and Escape.

Waste rock will be stored in the form of dry stacked tailings, eliminating the possibility of a tailings dam breach. Future studies will examine using electric underground equipment.

Drost said they're in talks with a major forest harvester about co-funding tree planting on harvested areas on the property as a way to lower their carbon footprint. They're also partnering with Lakehead University researchers to determine if their ultramafic rock tailings can sequester carbon dioxide.

The company said it's still fine-tuning its metallurgical processes and metal recoveries. They've also talked to five smelters, both domestically and abroad, about off-take agreements.

Since Clear Air Metals was formed in the spring of 2020, the results from activity on the ground have been fast and furious.

Drost and Gallagher inherited an abundance of drilling and geological from Rio and Panoramic, who spent a combined $85 million in drilling the two deposits. Clean Air has since added 50,0000 metres of its own drilling.

The company said it maintains strong relationships with three area First Nations through a memorandum of agreement with the intent of building capacity with these communities to supply the operation with goods and services and workers.