Sudbury has a strategic role to play in Canada’s natural resources security and economic sovereignty.

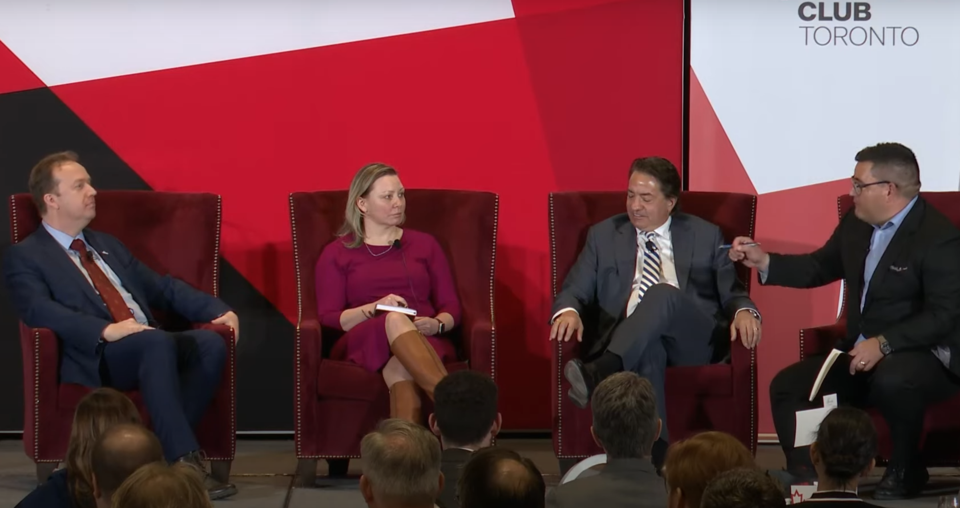

Greater Sudbury Mayor Paul Lefebvre delivered that message to an audience of corporate leaders and influencers at the Canadian Club Toronto, March 27, by inviting strategic partners and government funders to come north and invest in critical metals processing capacity in the city.

Lefebvre took part in a panel discussion that Canada is falling short in realizing its full potential due to the lack of investment in mid-stream processing that’s needed to feed the burgeoning battery, energy and defence sectors.

Instead of shipping critical minerals out of province and Canada for processing, mining-friendly cities like Sudbury can do it. It’s in our national interest to do so, he said.

The tariff and trade war launched against Canada by the Trump administration has provided one of those take-stock, pivotal moments in history that presents opportunities to capitalize on and help grow cities like Sudbury, Lefebvre said.

He used the podium to make an open-ended pitch to invite more value-added minerals processing for the city, specifically for a nickel sulphate plant with an adjoining precursor cathode active material (pCAM) facility to feed Canada’s battery materials supply. Ring of Fire mine developer Wyloo is proposing one for Sudbury.

Mining-friendly places like Sudbury can help Canada’s political leaders seize the moment and leverage the opportunity to deliver critical minerals to a world that wants them, Lefebvre said.

With an almost bottomless pit of critical minerals, Sudbury is already crowned as one of the world’s biggest base metal mining camps.

Lefebvre insists Sudbury has the resources, expertise and the land to become a major hub for processing critical minerals for Canada and the world.

The growing city of 180,000 has some built-in advantages.

Lefebvre pointed out that Sweden, considered a European mining powerhouse on its own, has 10 base metals mines in the entire country. Sudbury contains nine nickel, copper, cobalt and platinum-producing mines just within its city limits, with 10 more in the development pipeline.

In calling the city a “powerhouse of sustainable mining innovation,” Sudbury has one of the most advanced, integrated mining complexes in the world with two smelters, two refineries and a mill.

This sector is supported by more than 350 mining service and supply businesses that not only cater to the local mining community, but to customers around the world. Three post-secondary institutions in the city provide innovation and applied research capacity.

“This ecosystem, I would argue, is a strategic advantage for the entire democratic world, let alone Canada,” said Lefebvre.

Sudbury’s processing capacity is so invaluable that the only nickel mine in the U.S., the Eagle Mine in Michigan’s Upper Peninsula, ships its ore across the border for processing in Sudbury’s smelters.

Lefebvre said if Canada doesn’t build these plants in mining-friendly communities like Sudbury, it might not get built in a timely fashion and the opportunity will be squandered.

“We want to see more done here,” he said. “We have the land, we certainly have the talent and the resources (nine mines) and over 100 years of mineral processing experience to do this.”

To chase this opportunity, Lefebvre is out to secure some corporate buy-in by leading a group of local mining executives and Indigenous leaders on a trade mission to Japan and South Korea next week, hoping to entice some globally renowned battery manufacturers to set up shop in the city.

Lefebvre proposed formulating a national strategy that includes prioritizing mining to ensure Canada isn’t leaving its economic future in the hands of other countries.

To make that happen, Lefebvre said, exploration and development of new mines must be prioritized and accelerated to maintain Canada’s competitive edge.

Since mining is a capital-intensive endeavour, he said, more off-take agreements with downstream customers need to be explored and more government tax incentives offered.

The Ford government’s recent introduction of a $500-million critical minerals processing fund, Lefebvre calls a “gamechanger.”

But government must speed up on mine permitting and be consistent on its timelines in order to derisk projects and provide certainty for companies and investors.

“Projects should be encouraged by government, not hampered.”

Sudbury-born securities lawyer Perry Dellelce agrees there is a compelling case to be made for Sudbury to become a critical minerals processing hub in a natural resources-producting nation.

Mineral supply is not an issue, he said. “There is more ore in the Sudbury basin than the world can handle.”

It’s the processing side that’s underutilized and undercapitalized.

The founder and managing partner of Toronto-based Wildeboer Dellelce LLP, a leading firm in natural resources financing, Dellelce said Sudbury always does well to attract financing for exploration and mine development.

“Almost every time we see a boom in financing in mining, it starts in Northern Ontario and specifically in Sudbury.”

What’s lacking is the investment in infrastructure to support the secondary processing opportunities in Sudbury and Northern Ontario.

Dellelce points out that Sudbury’s two major miners are foreign-owned and “are not as invested in the community as they should be,” which means the city needs to attract outside third party capital, along with government funding, to lead the way.

As a staunch hometown booster, Dellelce said he’s determined to help get that message out.

With a federal election underway, Dellelce is encouraged by Prime Minister Mark Carney and Conservative challenger Pierre Poilievre’s support of a streamlined one-project, one-permit process.

“That is huge; that will make a big difference if we can make that happen.”

Heather Exner-Pirot, director of natural resources, energy, and environment at the Macdonald-Laurier Institute, added that onerous federal regulations have translated to Canada not reaching its full potential.

“We could be producing more,” she said, alluding to a Mining Association of Canada report that said, since 2012, Canadian production of nickel, graphite and magnesium is down between 30 and 40 per cent.

Copper production is down 9 per cent. And despite Canada’s lithium potential, there was no production reported in 2022.

The previous federal government’s introduction of the 2019 Impact Assessment Act is largely blamed by industry for this slowdown due to a stringent approvals process that greenlit only one project, the Cedar LNG facility in British Columbia.

There’s no shortage of critical minerals in the ground, Exner-Pirot said, and the bottleneck is the processing aspect that needs to be advanced. Canada can step up and be that processor of choice to the world over China.

“There’s a lotta ore in this world. The problem is not the supply — the problem is who can process it?”

In issuing a call to arms, Exner-Pirot said because of Russia’s invasion of Ukraine, Europe is spending $800 billion to re-arm itself. Canada has to step up to provide the minerals to support a Western defence supply chain.

In the case of a war of attrition, victory comes down to who has the manufacturing capacity to outlast their adversary, she said. Today, China is at the top of the global list.

Exner-Pirot said Canada, as a friendly nation, has a national security imperative to fill that gap and provide a suite of processed niche metals that can go into munitions and other military hardware production for its allies.