First Mining Gold has locked up $8 million to advance gold projects in northwestern Ontario and Quebec.

The Vancouver mine builder announced that it’s closed a bought deal financing transaction for its Springpole project, located 110 kilometres northeast of Red Lake, and its Duparquet project in the Abitibi region of western Quebec.

First Gold Mining said earlier this month that it had struck a deal with two investment firms, Cormack Securities and Haywood Securities, to purchase shares of the company. The deal closed Sept. 26.

Springpole is the more advanced of the two projects. The company is moving it toward the end stages of a lengthy environmental assessment (EA) process that began six-and-a-half years ago. The company’s final EA document will be filed to government regulators next month. The company anticipates receiving final permitting approval by the end of 2025.

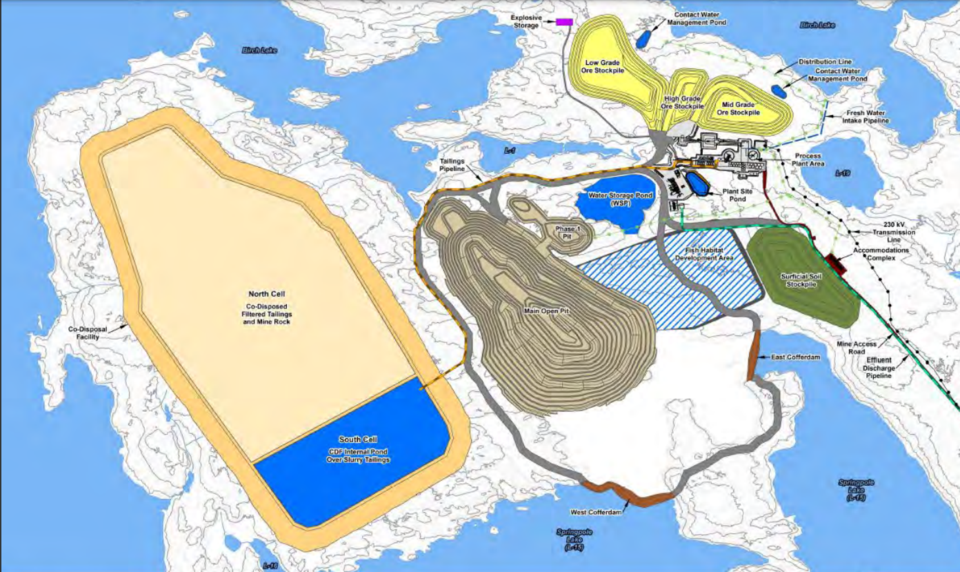

Springpole is a nearly 5-million-ounce deposit of indicated gold that could produce 300,000 ounces a year. The company has yet to make a construction decision but the plan is to drain a bay on a lake to access the gold under the lake bottom.

There’s also a silver resource at Springpole along with some tellurium, a critical mineral, discovered on the property.

Springpole has a projected 11-year mine life that could be extended as more exploration continues on the property, 400 kilometres northwest of Thunder Bay.

The property has been explored before, by other companies in the past. First Mining is re-examining old drill core and believes there's potential to find more gold further out from the main pit area.