Generation Mining is pocketing a huge chunk of change for construction of an open-pit palladium and copper mine outside Marathon on the north shore of Lake Superior.

The Toronto company announced just before Christmas that it had secured a $240-million streaming deal with Wheaton Precious Metals, the world's largest precious metals streaming company. Wheaton will take a sizeable chunk of the gold mined on the property and a portion of its platinum.

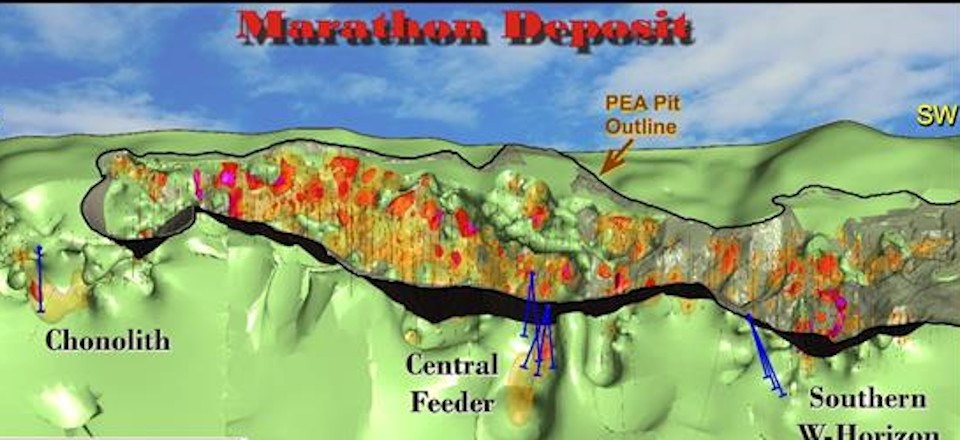

While Gen Mining is focussed on mining the palladium and copper at its Marathon project but there's also untapped platinum, gold and silver resources in the ground with much of the the 22,000-hectare property still to be explored.

A streaming transaction is a long-term purchase agreement that's used as a financing tool to build or expand mines. It provides for a large amount of money upfront in exchange for the right to acquire all or part of a particular precious metal.

Sign up for the Sudbury Mining Solutions weekly newsletter here.

In this deal, Wheaton will purchase 100 per cent of the payable gold production from the Marathon project until 150,000 ounces is delivered before dropping to 67 per cent of payable gold production for the life of the mine. Wheaton is also purchasing 22 per cent of the payable platinum production until 120,000 ounces is delivered, which then diminishes to 15 per cent for the life of mine.

In return, Wheaton will pay Gen Mining a $40-million deposit, early in 2022, with the rest of the $200 million staggered out in four installments over the 18-month period of the mine's construction.

The upfront capital costs to build the mine are estimated at $665 million. Gen Mining said the remaining project financing will be come through lending arrangements, metal off-take agreements and equipment financing.

In a Dec. 22 news release, Gen Mining management called the streaming deal with Wheaton a "key cornerstone financing commitment" for Marathon.

Over its projected 13-year mine life, the Marathon project will produce an estimated 1,905,000 ounces of palladium, 467 million pounds of copper, 537,000 ounces of platinum, 151,000 ounces of gold and 2,823,000 ounces of silver. But the property is thought to have the mineral potential to stay in production much longer.

The development promises more than 1,000 construction jobs and 400 permanent mining jobs.

In a recent conference call, Jamie Levy, Gen Mining's president-CEO, said there were a few second-guessers questioning the economics of Marathon and his management team's ability to raise money through a streaming deal or royalty agreement.

Moreover, some shareholders are upset with the departure of Sibanye Stillwater as a joint venture partner. But Levy countered Wheaton coming aboard as a project financing partner is validation "that this project is of merit and its time has come to be built."

Talks with Wheaton had been taking place over a couple months. There were other companies in the mix, he said.

With $25 million of the company's own money invested in the Marathon project, Chairman Kerry Knoll was pleased they were able to leverage a relatively small amount into a bigger chunk of funding.

Want to read more stories about business in the North? Subscribe to our newsletter.

The start of mine construction will likely take place next fall, according to COO Drew Anwyll. A federal and provincial environmental assessment of the project is underway. Hearings to receive public feedback are scheduled to begin Feb 15 and will last 30 days.

After that, a government-appointed review panel will take 90 days to write a final report for review by federal and provincial environment ministers. If all goes well and they give their collective blessing, permits to begin construction will be delivered in short order.

Anwyll.said initial construction could start as early as September or October, or as late as November or December. The company is eyeballing commercial mining production tentatively beginning in late 2023 or early 2024.