A final decision on whether to proceed with the development of an open-pit gold mine near Gogama is coming in early 2019.

IAMGOLD released a feasibility study for its Côté Gold Project in northeastern Ontario on Nov.1.

It’s the last technical and economic study done by a mining company in the various steps of assessing whether to bring a prospective property into production. The company had previously released a pre-feasibility study in June 2017.

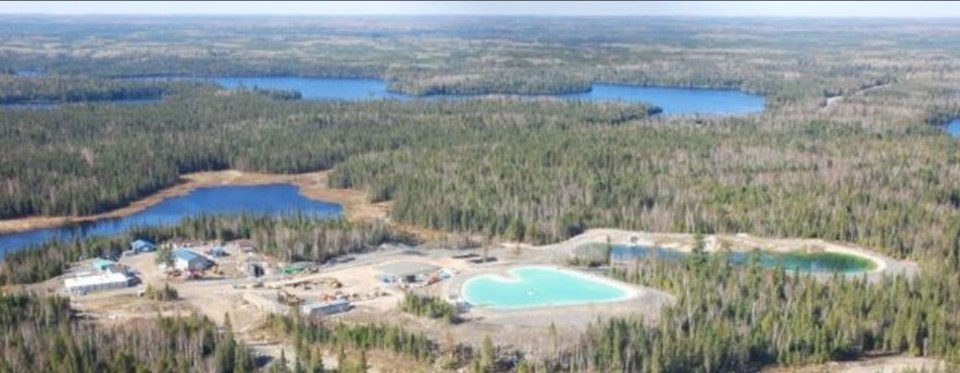

The Côté Gold site is located five kilometres off of Highway 144, 20 kilometres southwest of Gogama, and is roughly halfway between Sudbury and Timmins. IAMGOLD has a 70-30 joint venture interest with Sumitomo Metal Mining on this project.

The Toronto mine developer has two mine plan scenarios to consider.

The base case projects a 16-year mine life with average annual production of 367,000 ounces and all-in sustaining costs of $694 per ounce. Years 1 through 12 will deliver 428,000 ounces annually.

An extended mine plan tacks on an extra two years to the mine’s life with all-in sustaining costs of $703 per ounce. Average annual production increases to 372,000 ounces.

In both scenarios, the upfront capital costs to carve it out remains at almost $1.15 billion.

Development will involve two years of pre-production mining before transiting into production mining. The average annual grade through the processing mill at the site will be 0.98 grams per tonne of gold for the base case plan, and 0.97 grams for the extended plan.

The feasibility study reveals the total proven and probable reserves at Côté Gold has jumped by 1.4 million ounces to 7.3 million ounces.

When compared to last year’s prefeasibility study, resources in the measured and indicated category grew by 1.9 million ounces to almost 10 million ounces. The inferred resources increased by 1.2 million ounces to 2.4 million.

The company is pleased to have a large and “solid low-cost” gold deposit.

"Côté Gold has progressed from an advanced exploration project to an economically robust development project with nearly 10 million ounces in measured and indicated mineral resources,” said IAMGOLD president-CEO Steve Letwin in a news release.

“I commend the team for their excellent work enhancing the project's economics, refining the development concept previously set out in the PFS (prefeasibility study), and substantially de-risking the project.”

On the financing side, the company is in discussion with lenders to double its credit facility from $250 million to $500 million, and extend the credit period. Those arrangements will be in place by year’s end.

The company will be spending $134 million to lease equipment for this truck and shovel operation.

With more than 500-square-kilometres at its disposal, IAMGOLD will continue with exploration surrounding the deposit.