Alamos Gold has high hopes for its newly branded Island Gold District outside of Dubreuilville.

The Toronto gold mining company finalized its acquisition of Argonaut Gold and its open-pit Magino Mine in mid-July.

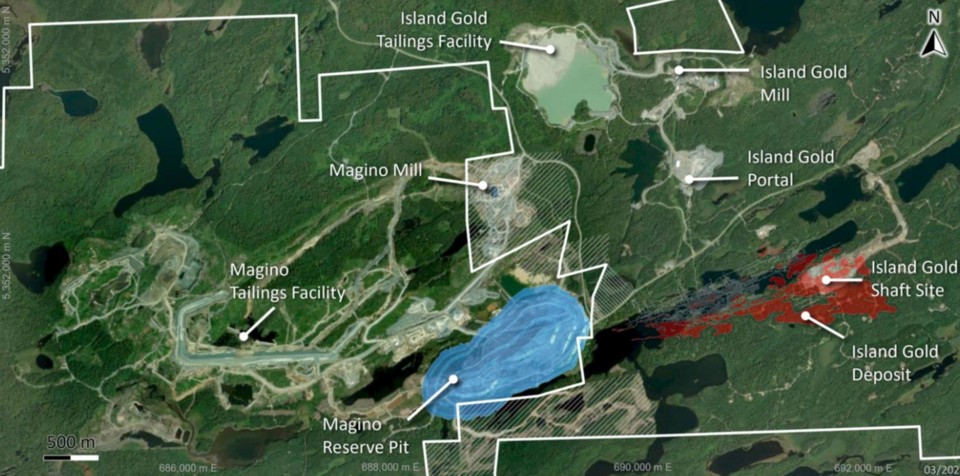

Integrating Alamos’ Island Gold mine with the neighbouring Magino Mine will create one of Canada’s largest and lowest cost mines, the company said.

Alamos delivered an update in a July 31 news release with its 2024 second quarter results, showing net earnings of US$70.1 million.

Adding Magino to the mix is expected to boost company-wide gold production to an annual rate of 600,000 ounces a year, Alamos said, with expected long-term production of more than 900,000 ounces.

In making the move to acquire Argonaut, Alamos is enamoured with the underground gold potential at Magino, which is adjacent to Island Gold; however, there’s also an opportunity to share infrastructure.

Island Gold is undergoing a major expansion, while Argonaut had gotten off to a struggling production start with Magino last fall. But Magino came equipped with a new processing mill and tailing dump. For Alamos, it means a significant cost savings as building those two facilities for Island Gold would no longer be necessary.

Starting next year, Island Gold ore will be processed at the Magino mill, “providing significant ongoing operating synergies,” the company said.

“We expect the integration of the two operations to drive substantial synergies and unlock significant longer-term upside potential supported by the broad-based exploration success we are seeing across the Island Gold District,” said Alamos president-CEO John McCluskey in a statement.

Company-wide, Alamos recorded a record haul during the quarter of 139,100 ounces of gold, way above the quarterly gold targets of between 123,000 and 133,000 ounces. Island Gold alone produced 41,700 ounces, up 37 per cent from the same period last year. The mine’s gold production for the first half of 2024 was 75,100 ounces.

Production in the third quarter of 2024 is expected to be between 145,000 and 155,000 ounces and will include production from Magino.

Alamos finished the quarter with US$313.6 million in cash, up 31 per cent from the previous quarter. The company was reportedly debt-free at the end of the quarter.

There remains considerable gold upside around Island Gold. Alamos is spending $19 million on exploration on the Dubreuilville-area property this year, up from the $14 million budgeted in 2023.

Last year’s exploration efforts boosted Island Gold’s reserves and resources by 16 per cent to now total 6.1 million ounces. Alamos said these prospective close to the mine should give them enough runway to continue mining for several years.

“We remain well positioned to achieve full year guidance, and deliver significant production growth, at declining costs over the next several years,” McCluskey added.

Near Matachewan, Alamos’ Young-Davidson Mine delivered a strong performance with 44,000 ounces during the second quarter and 84,100 ounces for the first half of this year. Alamos attributed that performance to higher mining rates, grades mined and processed.

Young-Davidson continues to be a money-maker in generating more than $100 million in cash flow for three consecutive years. Alamos said Young-Davidson is well positioned to deliver similar results this year and over the long term with a 15-year mineral reserve life.