Algoma Steel Group Inc. is perking up after a series of bad breaks that began with a Jan. 20 piping collapse at its coke-making facility.

"We expect to close out our fiscal year on a high note, with steel production back to normal levels and our end markets looking strong," said Michael Garcia, chief executive officer at the Sault steelmaker.

"This is thanks to the efforts of our entire team, who quickly recovered our blast furnace facilities from the Jan. 20 incident at our coke-making utility corridor, allowing us to capture attractive pricing in our order book that partially offset the effect of impacted shipments in the fiscal fourth quarter," Garcia said in written guidance issued for its fiscal fourth quarter ended March 31.

Algoma's winter of misfortune began with January's structural collapse of a key support structure carrying utilities essential to its coke-making and ironmaking operations.

This resulted in a temporary shutdown of #7 Blast Furnace to allow repairs to be made.

The following account was provided by the company at a community liaison committee meeting three weeks ago:

- structure supporting utilities piping at our coke-making plant collapsed on Jan. 20, 2024

- the incident resulted in abnormal coke oven gas flaring and air emissions

- a quantity of effluent left our site initially, and potential sources of discharge were contained later that day

- a battery repair plan was prepared in accordance with the Coke Making Environmental Compliance Approval to ensure the safety of personnel, maintain the assets and systematically restore operations

- this plan requires some facilities to operate at reduced capacity (10-15 per cent, which necessitates venting pressure to atmosphere when charging of ovens for safety reasons)

- included in the plan is a request for a temporary exemption from the battery fugitive emission limits until the battery repair plan is complete. This request has been approved by the Ontario Ministry of the Environment, Conservation and Parks on March 4, 2024

On the evening of Feb. 7, as Algoma was working to bring #7 Blast Furnace back to full production, slag made contact with moisture in a hot iron trough in the furnace's north casthouse.

This resulted in an explosion that affected 12 workers, five of whom were treated and released at Sault Area Hospital.

One week ago, the steelmaker advised its workers of a further workplace humiliation, this time at a canteen in the plate and strip mill.

"We discovered that water used to prepare coffee and in warming trays in the canteen was mistakenly supplied by river water instead of our usual potable supply," said an email to workers.

"We immediately discontinued the use of water at the facility and later closed the facility," the company advised.

The email said no reports of illness were received from workers who consumed Algoma's bespoke java varietals infused with St. Marys River tasting notes.

Despite these weeks of operational foul-ups, the steelmaker appears to be on the rebound.

It reported Monday that its fiscal 2024 fourth-quarter total steel shipments are expected to be in the range of 445,000 to 460,000 tons.

Adjusted EBITDA is expected to be in the range of $30 million to $40 million.

But the Algoma gremlins reduced production by 120,000 to 150,000 net tons.

"Demand for our products remains strong, and market prices for hot rolled coil have been on the rise," Garcia said.

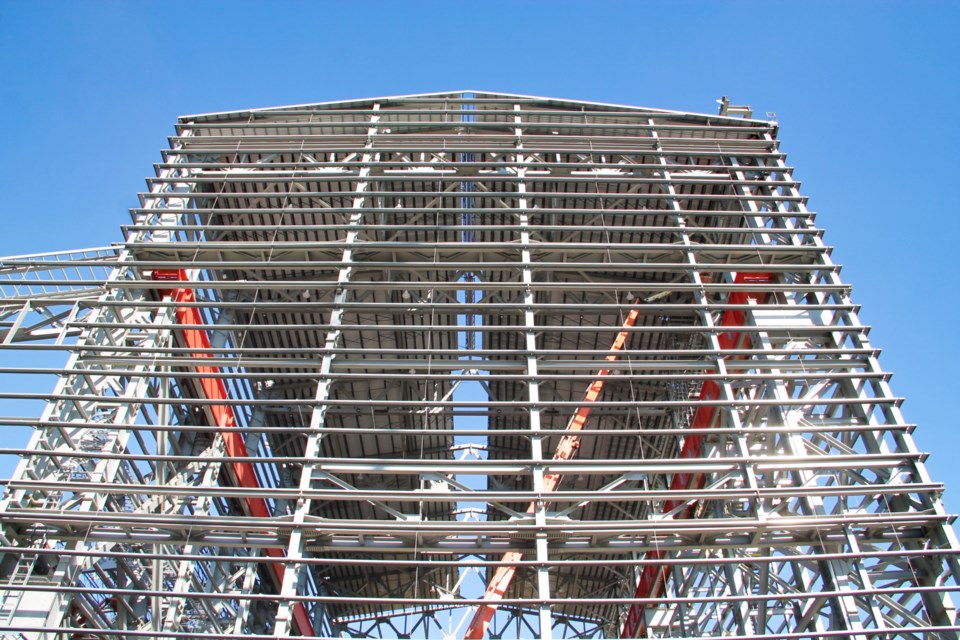

"With a return to full production, we expect an improvement in our fiscal first-quarter results. Importantly, our electric arc furnace (EAF) project remains on schedule and within budget, with commissioning activities expected to start by the end of 2024.

"We have continued to secure contracts to advance the EAF project, which now totals approximately $788 million, most of which are on fixed-price terms, reducing budget risks.

"While we are happy with the progress made so far and the project being on time and on budget, the management team remains laser-focused on de-risking project execution and beginning to realize the significant benefits of this transformative project, marking the start of a new era of steelmaking at Algoma," Garcia said.

Meanwhile, Algoma Steel Group Inc. also announced that its indirect wholly owned subsidiary Algoma Steel Inc. will offer for sale US$350 million in senior secured second lien notes due in 2029.

These notes will be guaranteed on a senior secured basis by ASI’s immediate parent company and all of ASI’s subsidiaries.

Pricing and consummation of the offering will be subject to market and other conditions.

"ASI intends to use the net proceeds from the offering of the notes for general corporate purposes, adding strength and flexibility to its balance sheet,” a news release said.

— SooToday